Creating a Business Plan for Your Life

While we take great pride in our investment management capabilities, it’s not the only essential service we provide to our private clients. To be as fully prepared as possible for retirement – or what’s next in life – it is important to factor “non-investment” considerations into your overall wealth and financial strategy. Here are some of those considerations:

- How much after-tax income do you need in retirement?

- What should your expenses be throughout retirement to ensure you don’t outlive your money?

- Are you planning on making any major purchases?

- Have you planned for the possible expense of a major health issue?

- What amount of portfolio risk should you take early in retirement versus later in retirement?

- How much cash should you have on hand?

- When should you take your Social Security?

- Does your estate plan account for current federal estate tax exemptions?

To achieve a worry-free, enjoyable, and fulfilling retirement, it is critical to having a plan with the flexibility to deal with all of the above questions and concerns, and others not listed here. It is also important to effectively navigate the inevitable “things” that life throws at you. Saving for retirement is not enough. There are many factors that can positively or negatively impact your retirement – and we are here to help you manage them.

Rather than focusing on only investments as many advisors do, our strategy is based on cash flow, portfolio risk, tax awareness, and estate preservation while simultaneously dealing with multiple what-if scenarios as things can, and do, change over time. The result is the creation of a keen awareness of the importance of addressing all areas of all significant areas of one’s financial life, and the impact each has on the others.

True wealth management strategies should:

- Integrate and coordinate all relevant financial aspects of a client’s life

- Incorporate cash flow, tax awareness and the need to take the appropriate risk

- Accommodate various what-if scenarios to be prepared for life’s uncertainties

- Quantify freedoms allowing you to enjoy what you have worked so hard to achieve

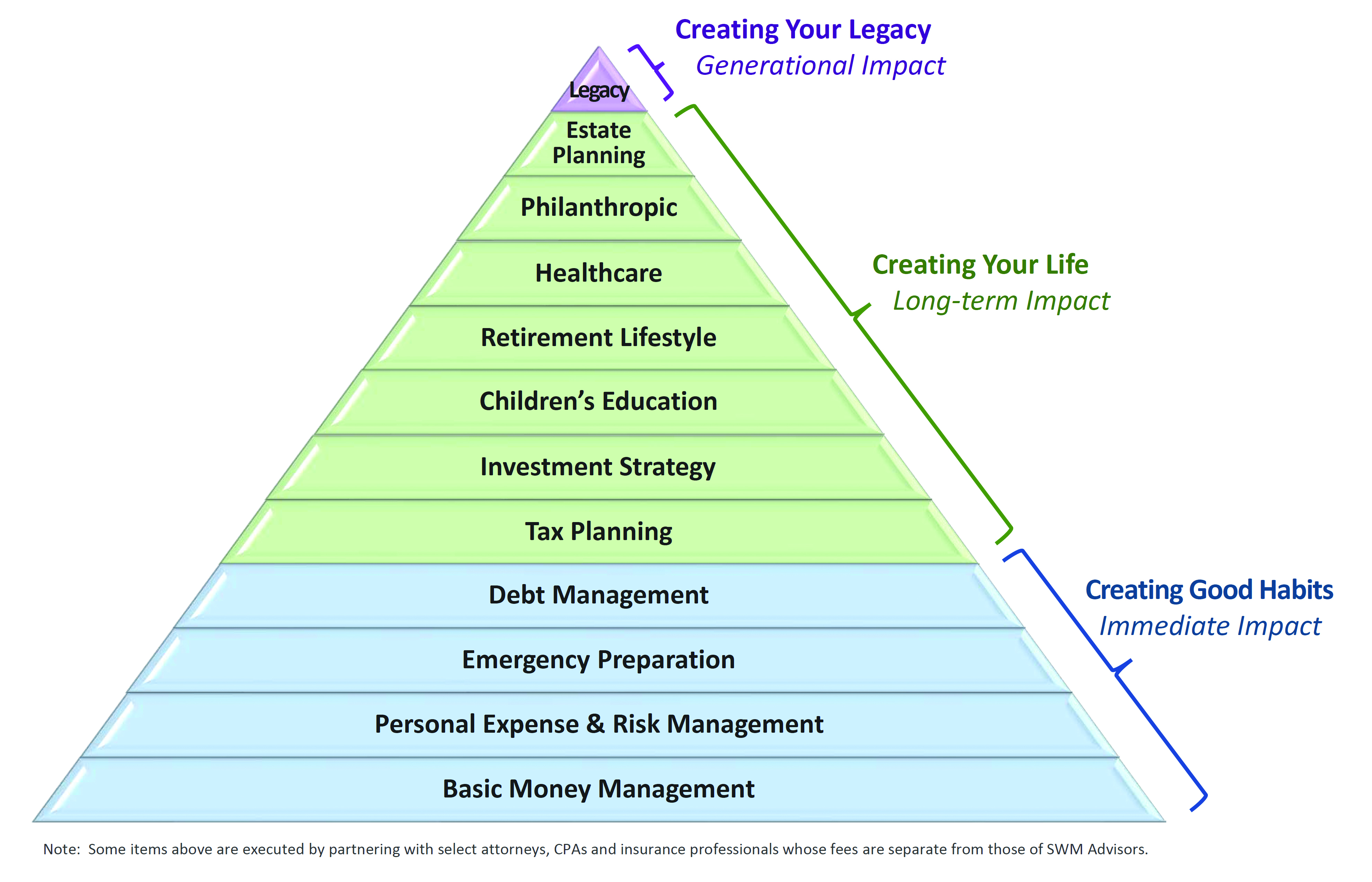

As shown in the above pyramid, we work on the things that will have an immediate impact, a long-term impact and a generational impact on our client’s lives. To be sure, not all clients have the need to address all twelve pyramid items but the vast majority of clients will have most of them factored into their business plan for life.