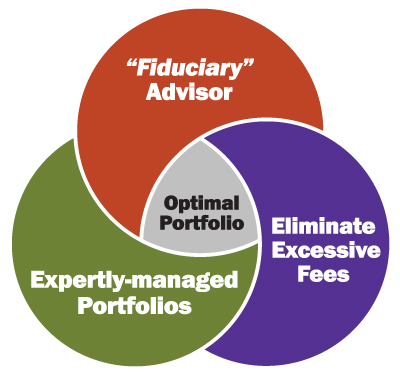

the power of three

Click Color Components To Learn More

Click Color Components To Learn More

Each of these three components are necessary to build a high-quality, low-cost, properly-diversified and risk-appropriate investment portfolio – but they are not sufficient on their own. Combining all three, in the right way, maximizes any investor’s probability of success – be that an individual, a corporate retirement plan or a foreign central bank.

The data behind this powerful combination is backed by data from objective and independent studies by world-class academics, mathematicians, statisticians, economists and Nobel Laureates.

Since investors get to choose, the question is, who will you choose to believe? Globally-experienced investment advisors equipped with data from unbiased, independent sources with no conflicts of interest – or the brokerage firms, banks, insurance companies and mutual funds that offer excessive fees & expenses and undisclosed conflicts of interest?

Our Fiduciary Standard

As legal fiduciaries, we are committed to managing our clients capital by exercising objectivity, prudence and good judgment – all while keeping the very best interests of our clients in mind. We fully adhere to the six core Fiduciary Standard principles:1

- Put the client’s best interests first.

- Act with prudence; that is, with the skill, care, diligence and good judgment of a professional.

- Do not mislead clients; provide conspicuous, full and fair disclosure of all important facts.

- Avoid conflicts of interest.

- Fully disclose and fairly manage, in the client’s favor, unavoidable conflicts.

- Keep costs low.

Our standard of client care goes well beyond the “suitability” standard of traditional brokerage firms. While these typical brokers/advisors must recommend investments that are suitable for their clients, that does not necessarily mean they are the best investments for their clients – and generally they are not.

In short, we don’t think “suitable” is good enough. We believe investors want, and deserve, better. As fiduciaries, we embrace the fact that we always sit on the same side of the table as our client – where the interests of our clients always come first.

Fee-only Investment Advisor

Seabridge Wealth Management, LLC is a fee-only investment advisory firm. Not fee-based, but fee-only.

The term “fee-based” was a catchy term created by Wall Street to give the impression the broker is only charging a fee but, in reality, means the broker can charge an advisory fee and commissions. It is a subtle but incredibly powerful, and costly, difference for investors. Our only fee is one we charge based solely on the amount of our client assets under management. There are no commissions, no distribution fees, no sales charges, or any other forms of compensation.

By law, as a fiduciary, we have the obligation to always put our clients’ interests first and foremost. This fully aligns the objectives of our firm with our clients and removes any conflicts in the pursuit of client goals, the formulation of investment strategies, or the selection of investment products.

When investors use non-fiduciary advisors, such as commissioned brokers or advisors at the typical brokerage firms, that advice is usually “self-interested“ and centered on the excess fees and commissions they generate by placing clients in specific products – which is what they are told to do, and paid to do, by their firms.

Our Globally Experienced Team

In the investment management business, experience means a great deal.

Unfortunately for investors, most of today’s traditional brokers and advisors have little-to-no actual investment-related experience. Many of today’s brokers/advisors are relatively new to the business and most of them have no business giving advice on what an investor should do with their money or their portfolios.

Do not be confused by the dizzying array of titles at the brokerage firms: financial advisor, financial consultant, wealth advisor, wealth consultant, etc. They all mean the same thing: salesperson. These individuals are typically not “advisors.” They are salespeople, or “asset-gatherers,” and that is exactly how they are compensated. They are typically not paid to “manage” anyone’s money. They are paid – and paid handsomely – to bring money in the door.

Our opinion on real and legitimate experience in the investment advisory space is clear: the more of it an investment team has, the better. Being able to put on a Band-Aid does not necessarily make one a doctor. Continuing with the medical analogy, most would agree that it would not be wise to have open-heart surgery performed by a doctor fresh out of medical school. Similarly, it would be unwise to work with brokerage firm salespeople and asset-gatherers that have limited or no securities or asset management experience.

At Seabridge Wealth Management, LLC, we are fortunate to have a globally experienced and talented investment team. Our professionals have well-developed investment expertise honed and refined through decades of working with the portfolios of high net-worth individuals and some of the world’s largest and most sophisticated corporations, pension plans, sovereign wealth funds and foreign central banks.

Experience counts.

Safeguarding Client Funds

For our clients that are individuals and foundations, we have a custodial relationship with the Charles Schwab Advisor Services Institutional platform (“Schwab”)2. Schwab is one of the premier custodial platforms in the world with client assets under custody of over $2.4 trillion as of December 31, 2014.

Through Schwab, they are provided The Schwab Security Guarantee, which states that Schwab will cover 100% of any client losses in any Schwab account due to unauthorized activity. To further keep our client’s capital safe, it is our firm’s policy to never take possession of, nor have access to, client funds or securities. Client assets are held at Schwab at all times, where clients can view on-line their balances, positions, and trade activity at any time of their choosing.

We take client security and privacy very seriously. Please click on the following link to review our Privacy Policy.

Minimizing investment-related expenses is a critical and controllable part of any investment plan. While future asset class returns are uncertain, the impact of every dollar paid in trading costs, management fees, and sales expenses is crystal clear – it’s one dollar less you have working towards your financial goals and lowers your portfolio value.

Put another way, the more one pays to invest, the lower their returns will be. Paying higher investment management fees – typically for the pursuit of superior managers – has not been a winning strategy. A 2010 Morningstar study found for every asset class analyzed over every time period, funds with the lowest expenses produced higher total returns than funds with the highest expenses.1

Put another way, the more one pays to invest, the lower their returns will be. Paying higher investment management fees – typically for the pursuit of superior managers – has not been a winning strategy. A 2010 Morningstar study found for every asset class analyzed over every time period, funds with the lowest expenses produced higher total returns than funds with the highest expenses.1

We use low-cost, indexed strategies as core investment vehicles, which very effectively reduces our client’s overall investment-related expenses. Our extensive use of diversified-beta managed indexed strategies does not mean we believe all markets are perfectly efficient. We believe markets are Mostly Efficient.2

The observed results for superior performing managers has been erratic over time. Very few managers have consistently exceeded the return of benchmark indices after the deduction of fees. However, some markets are inherently less efficient and are characterized by less readily available information, poorer information quality, plus less scrutiny by analysts – such as non-US small cap stocks.

We will focus our evaluation of actively managed strategies in those market segments we believe to be less informationally efficient coupled with those individual managers with a proven record of consistently superior results in that space.

Importance of Diversification

The best performing market or asset class varies from year to year – and there is not a way to predict the best performers in advance. Therefore, prudent investors diversify their portfolios to participate in the gains of top performers while mitigating exposure to the poorest performers.

In the early 1950s, Harry Markowitz laid the foundation for Modern Portfolio Theory by showing that proper diversification is not simply adding more investments to your portfolio, but combining assets that behave differently; specifically, those with less than perfect correlations.1 The optimal outcome is a portfolio of investment assets whose collective expected risk has been lowered without reducing the collective expected return.

Proper diversification does not eliminate risk, it minimizes risk for a given return expectation while improving the potential for a less volatile path towards achieving investment objective

Importance of Asset Allocation

Independent studies have proven that asset allocation overwhelmingly determines the risk and return behavior of any investment portfolio.2 It’s not what an investor buys, it’s what an investor buys in relation to the other things they buy in their portfolio that matters.

Unfortunately, the asset allocation process receives far less attention as compared to the massive amounts of time and money spent on evaluating individual securities, sectors and geographical regions in the futile attempt to accurately predict where securities, and the markets in general, will go in the future.

A recent study by Vanguard found asset allocation explained, on average, 88% of a portfolio’s short-term return variability and more than 100% of a portfolio’s long-term level of return.3 These findings suggest security selection and market timing were meaningful detractors to a managed portfolio’s long-term performance.

At Seabridge Wealth Management, LLC, we fully embrace the importance of establishing, and maintaining, a properly diversified and prudently asset allocated portfolio.

Why?

This is because that is precisely what decades of objective and independent data – compiled by the world’s leading academics, statisticians and Nobel Laureates – tells us we should do.

Sub-Asset Class Contributions

The asset classes included in our asset allocation models are selected for the contributions they are expected to make to the overall portfolio. To further enhance diversification opportunities, broad asset classes are divided into sub-asset classes. The selected sub-asset classes, and their expected portfolio contributions, are summarized below:

Generally, more conservative asset allocation models have higher bond allocations with smaller stock allocations, while more aggressive asset allocation models have higher stock allocations with minimal bond allocations.