Importance of Asset Allocation

Independent studies have proven that asset allocation overwhelmingly determines the risk and return behavior of any investment portfolio.1 Its not what an investor buys, its what an investor buys in relation to the other things they buy in their portfolio that matters.

Unfortunately, the asset allocation process receives far less attention as compared to the massive amounts of time and money spent on evaluating individual securities, sectors and geographical regions in the futile attempt to accurately predict where securities, and the markets in general, will go in the future.

A recent study by Vanguard found asset allocation explained, on average, 88% of a portfolio’s short-term return variability and more than 100% of a portfolio’s long-term level of return.2 These findings suggest security selection and market timing were meaningful detractors to a managed portfolio’s long-term performance.

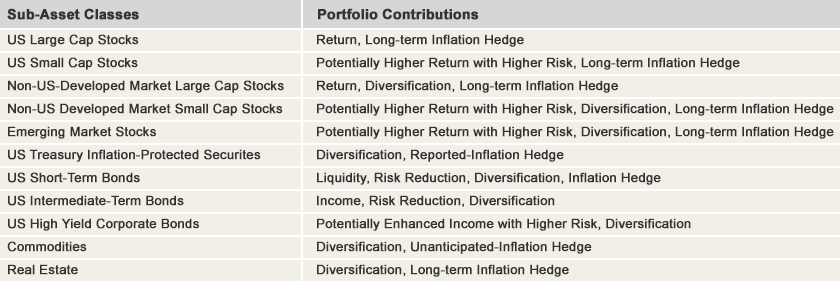

Sub-Asset Class Contributions

The asset classes included in our asset allocation models are selected for the contributions they are expected to make to the overall portfolio. To further enhance diversification opportunities, broad asset classes are divided into sub-asset classes. The selected sub-asset classes, and their expected portfolio contributions, are summarized below.

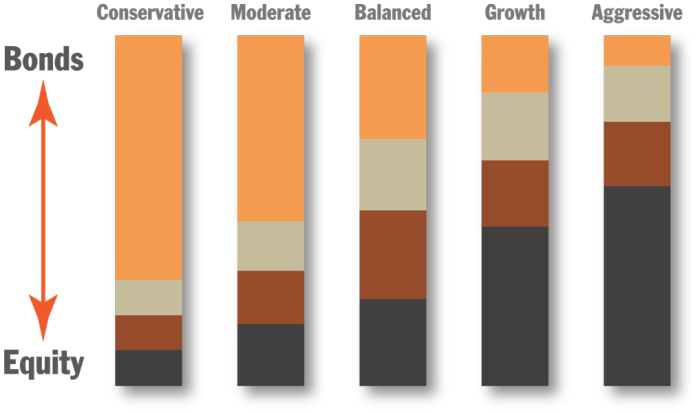

Generally, more conservative asset allocation models have higher bond allocations with smaller stock allocations, while more aggressive asset allocation models have higher stock allocations with minimal bond allocations.

2 Brinson, Gary P., L. Randolph Hood, and Gilbert L. Beebower. 1986. “Determinants of Portfolio Performance.”Financial Analysts Journal, vol. 42, no. 4 (July/August): 39-48. Brinson, Gary P., Brian D. Singer, and Gilbert L. Beebower. 1991. “Determinants of Portfolio Performance II: An Update.” Financial Analysts Journal, vol. 47, no. 3 (May/June): 40–48. Ibbotson, Roger G., and Paul D. Kaplan. 2000. “Does Asset Allocation Policy Explain 40, 90, or 100 Percent of Performance?” Financial Analysts Journal, vol. 56, no. 1 (January/February): 26–33.

3 Wallick, Daniel W., Julieann Shanahan, Christos Tasopoulos, and Joanne Yoon. 2012. “The Global Case for Strategic Asset Allocation.” (July). The Vanguard Group.